filetype:pdf the psychology of money

Exploring the psychology of money reveals how emotions‚ behaviors‚ and experiences shape financial decisions. Morgan Housel’s book highlights that success with money is more about behavior than knowledge‚ emphasizing the role of personal stories and emotional influences in shaping financial outcomes.

1.1. Overview of the Book by Morgan Housel

Morgan Housel’s The Psychology of Money explores how emotions‚ experiences‚ and social influences shape financial decisions. Through 19 engaging stories‚ Housel emphasizes that money management is less about knowledge and more about behavior. His insights challenge traditional views‚ offering a unique perspective on achieving financial success by understanding human behavior and emotional responses to money.

1.2. Key Premise: Behavior Over Knowledge

The central idea of The Psychology of Money is that financial success is less about what you know and more about how you behave. While knowledge provides a foundation‚ it is behavior—discipline‚ patience‚ and emotional control—that ultimately determines financial outcomes. Housel argues that understanding human behavior is crucial for making better financial decisions.

Behavior often trumps knowledge because emotions and personal experiences play a significant role in decision-making. This premise challenges the notion that mathematical formulas alone can guarantee financial success‚ emphasizing the importance of psychological awareness in achieving long-term financial stability.

The Role of Emotions in Financial Decisions

Emotions significantly influence financial decisions‚ with fear and greed often driving irrational choices. Loss aversion and risk aversion further compound these emotional impacts‚ shaping monetary behavior.

2.1. Fear and Greed: The Twin Drivers of Money Behavior

Fear and greed are the primary emotional forces behind financial decisions. Fear often leads to risk aversion and loss aversion‚ causing individuals to make conservative choices. In contrast‚ greed drives excessive risk-taking and impulsive behaviors. These emotions create a volatile mix‚ influencing everything from investment strategies to spending habits‚ often leading to irrational outcomes that contradict logical reasoning. Balancing these forces is crucial for sound financial judgment.

2.2. Loss Aversion and Risk Aversion

Loss aversion and risk aversion are fundamental biases influencing financial behavior. People tend to feel the pain of losses more intensely than the joy of gains‚ leading to overly cautious decisions. This mindset often results in avoiding risks‚ even when potential rewards are substantial. Such behavior can hinder growth and innovation‚ as individuals prioritize safety over opportunity‚ especially in uncertain markets.

Cognitive Biases and Money

Cognitive biases significantly influence financial decisions‚ often leading to irrational choices. Understanding these biases is crucial for improving financial outcomes and decision-making processes.

3.1. Anchoring Bias in Financial Choices

Anchoring bias influences financial decisions by relying too heavily on the first piece of information encountered. For instance‚ investors might cling to a stock’s initial price‚ even as market conditions change. This cognitive bias leads to suboptimal choices‚ as individuals fail to adapt to new data. Recognizing anchoring bias is crucial for making more rational and informed financial decisions.

3.2. Confirmation Bias and Financial Mistakes

Confirmation bias often leads to costly financial mistakes by reinforcing pre-existing beliefs. Investors may selectively seek information that aligns with their views‚ ignoring contradictory evidence. This cognitive distortion can result in poor investment decisions‚ such as holding onto losing stocks too long or avoiding promising opportunities. Awareness of this bias is key to mitigating its impact on financial judgment and fostering more objective decision-making.

The Impact of Social Influence on Money Behavior

Social influence significantly shapes financial behavior‚ as people often mirror spending habits of peers or societal norms‚ driven by cultural pressures and the desire to conform.

4.1. Keeping Up with the Joneses: Social Pressure and Spending

Social pressure often drives individuals to spend beyond their means to match the lifestyle of others‚ fueled by emotional desires for status and acceptance. This behavior‚ known as “keeping up with the Joneses‚” creates a cycle of debt and dissatisfaction‚ as people prioritize short-term appearances over long-term financial stability‚ highlighting the psychological impact of societal expectations on spending habits.

4;2. The Role of Culture in Shaping Financial Attitudes

Cultural norms significantly influence financial attitudes‚ with values like thriftiness‚ materialism‚ or communal sharing varying widely across societies. These cultural differences shape spending‚ saving‚ and investment behaviors‚ often unconsciously guiding financial decisions and reflecting broader societal priorities‚ illustrating how deeply embedded money attitudes are within cultural frameworks and traditions.

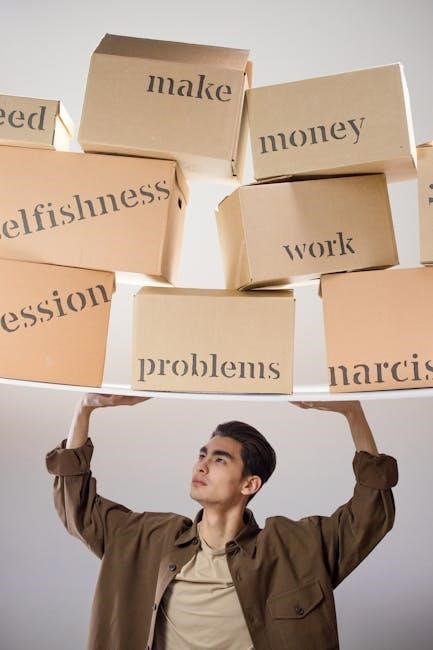

Behavioral Economics and Financial Decision-Making

Behavioral economics reveals how psychological biases influence financial choices‚ often leading to irrational decisions. It combines insights from psychology and economics to explain why people deviate from logical outcomes.

5.1. The Limits of Rationality in Money Matters

The limits of rationality in money matters are evident as emotions and biases often override logical decision-making. Traditional economic theories assume rational behavior‚ but psychological factors like fear‚ greed‚ and cognitive biases frequently lead to suboptimal financial choices‚ highlighting the gap between theory and real-world behavior in managing money.

5.2. The Power of Framing in Financial Choices

The power of framing significantly influences financial decisions‚ as the way information is presented alters perceptions. Positive framing‚ such as emphasizing gains‚ encourages risk aversion‚ while negative framing‚ like highlighting losses‚ can lead to risky behavior. This psychological phenomenon underscores how subtle changes in presentation can profoundly impact financial choices and economic decision-making principles.

The Psychology of Wealth and Poverty

Wealth and poverty are not just financial states but deeply rooted in mindset and psychology. Wealth often fosters confidence and security‚ while poverty can lead to financial insecurity and stress‚ shaping behaviors and decisions differently.

6.1. The Mindset of the Wealthy vs. the Poor

The wealthy often exhibit a mindset focused on long-term investments‚ asset accumulation‚ and financial independence‚ while the poor may prioritize immediate survival needs. Wealthy individuals tend to view money as a tool for growth‚ whereas those in poverty often see it as a scarce resource for daily expenses. These mindsets shape financial behaviors and opportunities differently.

6.2. The Psychological Consequences of Financial Insecurity

Financial insecurity often leads to heightened stress‚ anxiety‚ and a sense of helplessness. Individuals may experience impaired cognitive functioning‚ strained relationships‚ and lower overall well-being. Chronic financial instability can erode self-esteem and fosters a mindset of scarcity‚ making it harder to escape the cycle of poverty and achieve long-term financial stability.

Money and Identity

Money often reflects personal values‚ beliefs‚ and societal status‚ shaping self-identity. It influences how individuals perceive their worth and position within social hierarchies‚ impacting self-esteem and life choices.

7.1. How Money Reflects Personal Values and Beliefs

Money often serves as a mirror of personal values and beliefs‚ influencing financial decisions and self-perception. Individuals’ spending habits reflect their priorities‚ while societal norms shape perceptions of wealth and status‚ linking money to identity and self-worth. This interplay highlights how financial choices are deeply rooted in personal and cultural values‚ guiding behavior and life goals.

7.2. The Role of Money in Self-Identity and Status

Money significantly influences self-identity and social status‚ often shaping how individuals perceive themselves and their place in society. Spending habits and wealth accumulation can reflect personal aspirations and societal expectations‚ creating emotional connections to financial success. This dynamic underscores how money becomes a tool for self-expression and validation‚ deeply intertwining with one’s sense of identity and social standing.

The Psychology of Spending and Saving

Spending and saving are deeply influenced by emotional triggers‚ impulses‚ and psychological biases‚ often reflecting a conflict between immediate gratification and long-term financial security.

8.1. Emotional Spending and Impulse Buying

Emotional spending and impulse buying are driven by feelings like stress‚ excitement‚ or social pressure‚ often leading to uncontrolled purchases. These behaviors‚ rooted in psychological triggers‚ can overshadow logical financial decisions‚ creating a cycle of regret and financial strain. Recognizing these emotional drivers is crucial for fostering healthier spending habits and long-term financial stability.

8.2. The Challenges of Long-Term Financial Planning

Long-term financial planning is often derailed by emotional distractions‚ impulsive decisions‚ and a tendency to prioritize short-term gains over future security. People frequently underestimate their future financial needs and struggle with maintaining discipline. The lack of immediate rewards and the uncertainty of outcomes make it difficult to stay committed‚ highlighting the need for self-awareness and structured strategies to overcome these challenges.

Retirement and Financial Transitions

Retirement marks a significant psychological shift‚ transitioning from earning to preserving wealth. It involves emotional adjustments to financial independence and redefining life’s purpose beyond work.

9.1. The Psychological Shifts of Retirement Planning

Retirement planning involves emotional and mental adjustments‚ as individuals transition from earning to preserving wealth. It requires adapting to a new identity‚ managing financial anxiety‚ and coping with the loss of income. The shift often brings uncertainty‚ forcing individuals to redefine their sense of purpose and security‚ while balancing the desire for enjoyment with the need for long-term financial stability.

9.2. The Emotional Aspects of Financial Independence

Financial independence brings profound emotional shifts‚ often linked to a sense of security and reduced anxiety. Achieving it can evoke pride and fulfillment‚ yet it also requires managing the emotional challenges of maintaining discipline. The journey involves balancing spending desires with savings goals‚ while grappling with uncertainties about the future‚ all of which shape one’s mindset and relationship with money.

The Role of Uncertainty in Financial Behavior

Uncertainty profoundly shapes financial behavior‚ influencing risk assessment and decision-making. It often leads to cautious strategies‚ as individuals seek to mitigate unpredictable outcomes and maintain financial stability.

10.1. Decision-Making Under Uncertainty

Decision-making under uncertainty involves navigating unknown outcomes‚ often relying on mental shortcuts or heuristics. These strategies help individuals make choices despite incomplete information‚ though they can lead to biases. Uncertainty fuels risk aversion‚ as people tend to prefer predictable outcomes over unpredictable ones‚ even if it means lower potential returns. This mindset significantly influences financial behavior and investment choices.

10.2. The Impact of Uncertainty on Financial Risk-Taking

Uncertainty often reduces willingness to take financial risks‚ as individuals prefer avoiding losses to acquiring gains. This risk aversion intensifies under ambiguous conditions‚ leading to missed opportunities. The unpredictability of outcomes creates anxiety‚ causing hesitation in decision-making. Such behavior highlights the emotional and psychological challenges of navigating financial markets‚ emphasizing the need for strategies to manage uncertainty and build confidence in risky environments.

Practical Strategies for Better Financial Psychology

Cultivating awareness of emotional triggers and practicing disciplined habits are key. Leveraging psychological insights helps build resilience and improve financial decision-making over time consistently.

11.1. Cultivating Financial Discipline and Awareness

Developing financial discipline involves recognizing emotional triggers that lead to impulsive spending. Awareness of personal money habits encourages mindful decisions‚ fostering a healthier relationship with wealth. Regular self-reflection and goal-setting help maintain consistency‚ while understanding the psychological drivers behind spending patterns allows individuals to build sustainable financial routines and improve long-term outcomes effectively.

11.2. Leveraging Psychology to Improve Financial Outcomes

Understanding psychological biases like anchoring and confirmation can transform financial decision-making. By recognizing these patterns‚ individuals can counteract irrational behaviors‚ fostering better investment strategies and spending habits. Techniques such as mental accounting and framing financial goals positively also enhance discipline‚ leading to more consistent and profitable financial outcomes over time.